Financial analysis and decision making in a Peruvian tourism services company

DOI:

https://doi.org/10.51252/race.v3i1.685Keywords:

horizontal analysis, vertical analysis, pandemic, financial ratioAbstract

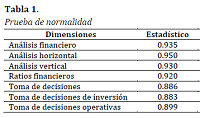

This research sought to examine the relationship between financial analysis and decision making in the tourism services company Rioja EIRL, located in the district of Rioja, Peru, during the periods 2019-2020. For this purpose, a basic type study, quantitative approach, correlational level and non-experimental design was used. The sample consisted of 20 employees, and questionnaires and documentary analysis were used for data collection. The results revealed a significant correlation between horizontal, vertical and financial analysis, as well as between financial analysis and decision making, with Spearman correlation coefficients of 0.721, 0.594, 0.658 and 0.671 respectively. Furthermore, it was observed that all these correlation coefficients had a p-value of less than 0.05. In conclusion, it is established that there is a positive correlation between financial analysis and decision making.

Downloads

References

Abdulshakour, S. T. (2020). Impact of Financial Statements on Financial Decision-Making. Open Science Journal, 5(2), 1–31. https://doi.org/10.23954/osj.v5i2.2260

Aguayo Carvajal, V. R., Ballesteros Ballesteros, E. Y., Sandoval Cuji, M. M., & Carranza Quimi, W. D. (2022). Análisis financiero: herramienta clave en la toma de decisiones empresariales. Brazilian Journal of Development, 8(10), 65042–65056. https://doi.org/10.34117/bjdv8n10-005

Alshowishin, A. (2021). Financial Analysis. International Journal of Scientific and Research Publications (IJSRP), 11(4), 208–211. https://doi.org/10.29322/IJSRP.11.04.2021.p11226

Berthilde, M., & Rusibana, C. (2020). Financial Statement Analysis and Investment Decision Making in Commercial Banks: A Case of Bank of Kigali, Rwanda. Journal of Financial Risk Management, 9(4), 355–376. https://doi.org/10.4236/jfrm.2020.94019

Casas Huingo, M., & Pastor Abanto, R. (2021). Análisis financiero para la toma de decisiones de inversión en la empresa Bustamante Vásquez Corporación SAC 2020. Universidad Privada Antonio Guillermo Urrelo. http://repositorio.upagu.edu.pe/handle/UPAGU/2240

Di Tommaso, M. R., Prodi, E., Pollio, C., & Barbieri, E. (2023). Conceptualizing and measuring “industry resilience”: Composite indicators for postshock industrial policy decision-making. Socio-Economic Planning Sciences, 85, 101448. https://doi.org/10.1016/j.seps.2022.101448

Hernandez-Celis, D., Hernandez-Celis-Vallejos, J. P., Hernandez-Vallejos, L. K., & Hernandez-Vallejos, A. D. R. (2022). Análisis financiero y económico para la toma de decisiones efectivas en sociedades anónimas. TecnoHumanismo, 2(3), 221–243. https://doi.org/10.53673/th.v2i3.117

Kadim, A., Sunardi, N., & Husain, T. (2020). The modeling firm’s value based on financial ratios, intellectual capital and dividend policy. Accounting, 6(5), 859–870. https://doi.org/10.5267/j.ac.2020.5.008

Kumar, P., Pillai, R., Kumar, N., & Tabash, M. I. (2023). The interplay of skills, digital financial literacy, capability, and autonomy in financial decision making and well-being. Borsa Istanbul Review, 23(1), 169–183. https://doi.org/10.1016/j.bir.2022.09.012

Li, X., Wang, J., & Yang, C. (2023). Risk prediction in financial management of listed companies based on optimized BP neural network under digital economy. Neural Computing and Applications, 35(3), 2045–2058. https://doi.org/10.1007/s00521-022-07377-0

Lyons, A. C., & Kass‐Hanna, J. (2021). A methodological overview to defining and measuring “digital” financial literacy. Financial Planning Review, 4(2), e1113. https://doi.org/10.1002/cfp2.1113

Raut, R. K. (2020). Past behaviour, financial literacy and investment decision-making process of individual investors. International Journal of Emerging Markets, 15(6), 1243–1263. https://doi.org/10.1108/IJOEM-07-2018-0379

Shala, B., Prebreza, A., & Ramosaj, B. (2021). Horizontal and Vertical Analysis of SAMSUNG Enterprise for the Years 2015-2016 and 2017-2018. Journal of Economics and Management Sciences, 4(1), 50–71. https://doi.org/10.30560/jems.v4n1p50

Uyar, A., Kilic, M., Koseoglu, M. A., Kuzey, C., & Karaman, A. S. (2020). The link among board characteristics, corporate social responsibility performance, and financial performance: Evidence from the hospitality and tourism industry. Tourism Management Perspectives, 35, 100714. https://doi.org/10.1016/j.tmp.2020.100714

Weerasekara, S., & Bhanugopan, R. (2023). The impact of entrepreneurs’ decision-making style on SMEs’ financial performance. Journal of Entrepreneurship in Emerging Economies, 15(5), 861–884. https://doi.org/10.1108/JEEE-03-2021-0099

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Javier Solsol-Chávez, Koraly Ximena García-Vásquez, Fernando Ruiz-Saavedra

This work is licensed under a Creative Commons Attribution 4.0 International License.